Theft Loss Deduction 2025. Extended deadlines to file, pay, and make contributions. Use form 4684, casualties and thefts, to calculate the deductible.

There is a special way to claim. If you had business losses in 2025 due to theft, you may be able to take a tax deduction for those losses.

Casualty and Theft Loss Deduction 2025, This article will outline which types of casualty and theft losses are deductible, who is eligible to deduct a loss, and when the loss can be deducted. The irs casualty and theft losses provision helps taxpayers recover from several kinds of losses through deductions.

IRS Form 4684 Instructions Deducting Casualty & Theft Losses, While most victims of crypto and nft fraud will not get their investments back, they may be able to take advantage of some tax benefits. If you had business losses in 2025 due to theft, you may be able to take a tax deduction for those losses.

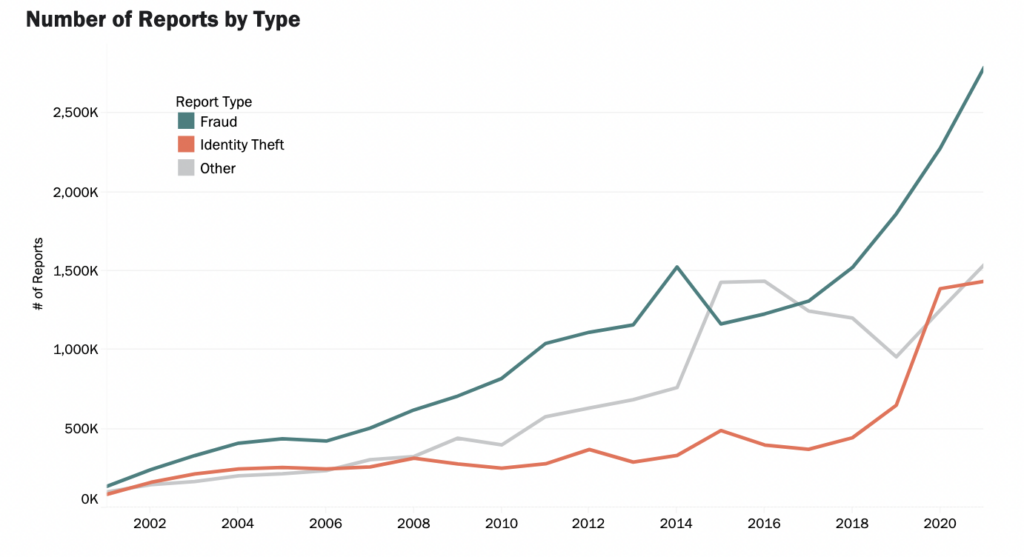

2025 Identity Theft Facts and Statistics, Extended deadlines to file, pay, and make contributions. This article will outline which types of casualty and theft losses are deductible, who is eligible to deduct a loss, and when the loss can be deducted.

Casualty and Theft Loss Deduction 2025, How to claim the disaster loss deduction on your tax return. Each of these casualties can be claimed as.

Claiming a Theft Loss Deduction if Your Business is the Victim of, According to internal revenue code section 165(e), theft losses are treated as sustained during the taxable year in which the taxpayer discovers the. If you incurred this type of loss, you can deduct it as one of these:

Casualty And Theft Loss Deduction For The SelfEmployed Crixeo, Understand the criteria for theft loss deduction and the. The internal revenue code has let some taxpayers deduct unreimbursed losses caused by recent disasters.

2025 HSA & HDHP Limits, Generally, small business owners can take. Use form 4684, casualties and thefts, to calculate the deductible.

The Definitive Cyber Security Statistics Guide [2025 Edition], Use form 4684, casualties and thefts, to calculate the deductible. Extended deadlines to file, pay, and make contributions.

![The Definitive Cyber Security Statistics Guide [2025 Edition]](https://www.thesslstore.com/blog/wp-content/uploads/2023/01/fbi-ic3-reported-losses-2021-shadow.png)

Mobile Theft and Loss Report 2025/2025 Edition Prey Blog, There is a special way to claim. Add up your total losses, subtract any insurance or other reimbursements, subtract $100, then subtract 10% of your.

Determining the Casualty and Theft Losses Deduction Webinar LinkedIn, Use form 4684, casualties and thefts, to calculate the deductible. Extended deadlines to file, pay, and make contributions.